Welcome to our Little Black Book, an inspirational series of business stories and insights from our brilliant members.

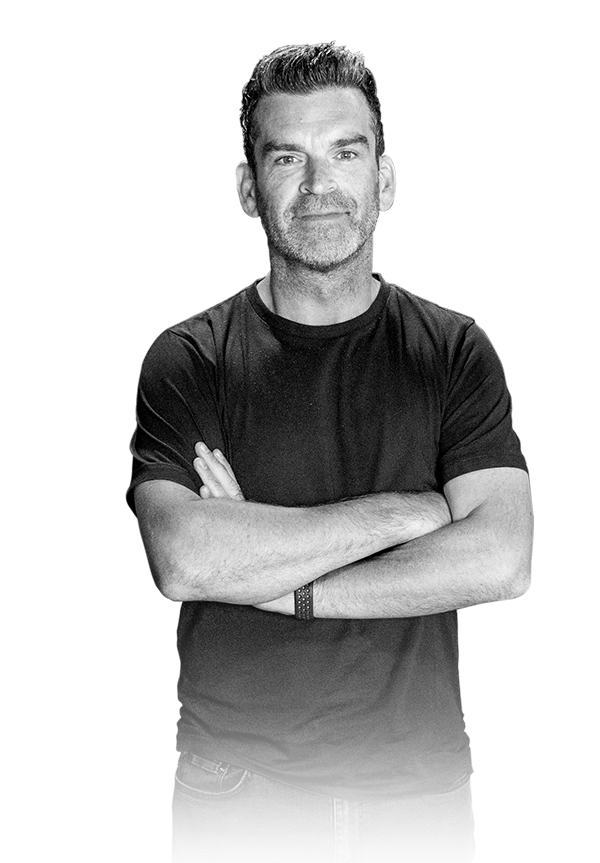

Mark Piper on advice against adversity

Mortgage Professional - Clover Financial Solutions

In a career that spans three decades, specialist mortgage professional Mark Piper has proficiently served the financial services sector through its rollercoaster of recession, regulation, macro influences, and embracement of new trends.

Having initially worked for some of the largest UK insurers including Abbey Life, Prudential, and Aviva, Mark left the corporate world to start his own mortgage and commercial brokerages with particular emphasis on those borrowers that traditionally get left behind by the high street lenders.

Ardent about helping those with adverse credit, Mark and his Team built one the country’s largest mortgage distributors recognised with industry awards and lender partnerships.

Connect on LinkedInDo you want more articles like this in your inbox? If so then register below...

Discover more of their secrets of success

Raveen Sandhu

Read more

Paul Hill

Read more

Ian Hurst

Read more

Emma Dzenis

Read more

Nicola McManus

Read more

Daniel Sagar

Read more

Chris Allcock

Read more

Jon Craddock

Read more

Coran Stubbington

Read more

Kaz Downing

Read more

Chris Ashby

Read more

Marc Bishop

Read more

Becky Davis

Read more

Aidan Cooper

Read more

Scott Rae

Read more

Jen Reynolds

Read more

Fiona Whyte & Ian Schenkel

Read more

Rich Webley

Read more

Matthew Edge-Wilkins

Read more

Justin Neale

Read more

Heather Pierpoint

Read more

Edita Talat-Kelpsiene

Read more

Dan Shilcock

Read more

Chris Hobbs

Read more

Ben Pike

Read more

Drew Patel

Read more

Wayne Freebody

Read more

Victoria Sedgley

Read more

Paul Marsh

Read more

Victoria Chapman

Read more

Paul Gallie

Read more

Adam Penny

Read more

Nick Carlile

Read more

Mimi Ronald

Read more

Carl Lamerton

Read more

Debbie Moreton

Read more

Rob Sheppard

Read more

Elaine Harding

Read more

Vicks Ward

Read more

Louis Lawrence

Read more

Dan Green

Read more

Ben Chiuriri

Read more

Sarina Mann

Read more

Mikaela Jubb

Read more

Chelsey & Joe Terrey

Read more

Terry Glassey

Read more

Richard Browning

Read more

Neil Lewis

Read more

Ashley Fernandes

Read more

Jane Johnson

Read more

Asa Moore

Read more

Chris Ward

Read more

Paul Clarke

Read more

Verity Lovelock

Read more

Stephen Long

Read more

Jenny Walker

Read more

Xavier Fiddes

Read more

Jude & Chris Wharton

Read more

Graham Bell

Read more

Dan Loveridge

Read more

Bex Fisher

Read more

Darren Jacobs

Read more

Glen Crump

Read more

Simon Hawtrey-Coombs

Read more

Steve Jones

Read more

Lawrence Bath

Read more

Rachel Young

Read more

Neil Kerr

Read more

Dan Gateshill

Read more

Matt Willsher

Read more

Callum Donnelly

Read more

Liz Clarke

Read more

Chris Nash

Read more

Andy Hooper

Read more

Sam Sutton

Read more

Tom Richards

Read more

Shaun Ramazannezhad

Read more

Darren Brown

Read more

Gareth Davies

Read more

Kevin Briscoe

Read more

Paul Sams

Read more

Hannah & Paul Wallis

Read more

Colin Buchan

Read more

Jamie Southall

Read more

Mark White

Read more

Paul Phelps

Read more

Simon Jenns

Read more

Spencer Bowman

Read more

Donovan Long

Read more

Steve Cole

Read more

Luke Newman

Read more

Zoe Hanson

Read more

Gavin Rampton

Read more

Matt Taylor

Read more

Helen Clements

Read more

Damian Gevertz

Read more

Chris Schutrups

Read more

Scott Stephens

Read more

Ben McMahon

Read more

Sally Golden

Read more

Matt Sanger

Read more

Jeremy Robbins

Read more

Nella Pang

Read more

Will Rosie

Read more

Callum Donnelly

Read more

Andy Hollands

Read more

Sam Griffiths

Read more

Alex Hurn

Read more

Zoie Golding

Read more

Ross Breckenridge

Read more

Richard Allen

Read more

Jon Martin

Read more

Steve Crawford

Read more

Louis Cross

Read more

Ian Riggs

Read more