Welcome to our Little Black Book, an inspirational series of business stories and insights from our brilliant members.

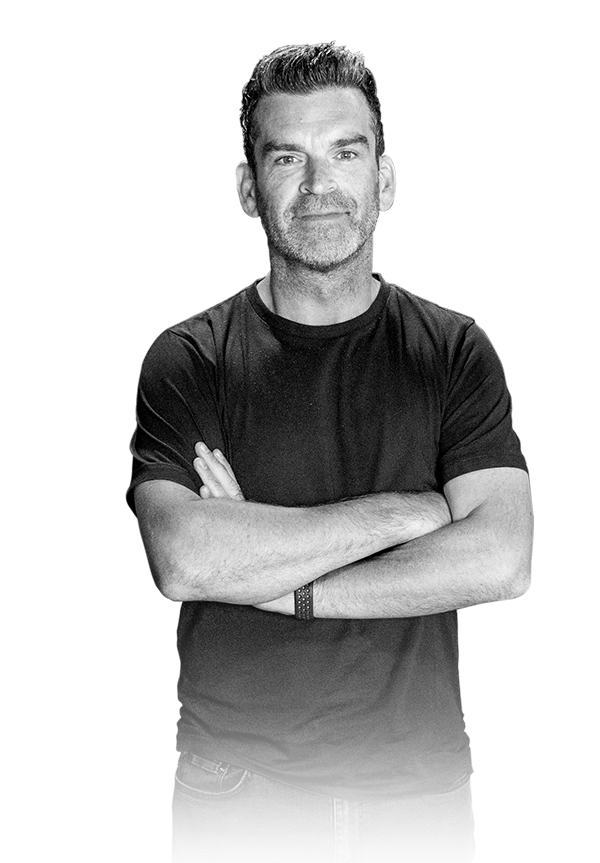

Shaun Ramazannezhad on the value of proactivity for your wealth

Financial Planner, McMillan Financial Advice Limited

Shaun Ramazannezhad, the Hampshire protégé of McMillan Financial Advice Limited, debuted in the financial services industry from a desire to help people and businesses protect and grow their wealth.

His transition from the corporate world working for a leading European manufacturing company into wealth management occurred via the St. James’s Place Financial Adviser Academy, from where Shaun progressed into Partner Practice McMillan Financial Advice Limited.

The avid gym-goer is an advocate for proactivity in financial planning to maximise the security and benefits the sphere brings. Approachable and relatable, Shaun is a next generation adviser who is passionate about providing a holistic approach to wealth management.

Connect on LinkedIn

Do you want more articles like this in your inbox? If so then register below...

Discover more of their secrets of success

Jarid Hixon

Read more

Cosmic Carrot

Read more

Nick Maguire

Read more

Ben Cross

Read more

Josh Chapman & Akis Zissis

Read more

Alec Smith

Read more

Gary Frost

Read more

Kelly Bruton

Read more

Josh Mitchell

Read more

Ashley Benfield

Read more

Mike Keats

Read more

Gary Light

Read more

Faye Williams

Read more

Victoria Hamilton

Read more

Phil Moulds

Read more

Rich Cook & Andrew Morgan

Read more

Raveen Sandhu

Read more

Daniel Sagar

Read more

Jon Craddock

Read more

Coran Stubbington

Read more

Marc Bishop

Read more

Scott Rae

Read more

Rich Webley

Read more

Justin Neale

Read more

Heather Pierpoint

Read more

Dan Shilcock

Read more

Ben Pike

Read more

Drew Patel

Read more

Wayne Freebody

Read more

Victoria Sedgley

Read more

Paul Marsh

Read more

Victoria Chapman

Read more

Debbie Moreton

Read more

Louis Lawrence

Read more

Dan Green

Read more

Sarina Mann

Read more

Mikaela Jubb

Read more

Chelsey & Joe Terrey

Read more

Richard Browning

Read more

Neil Lewis

Read more

Ashley Fernandes

Read more

Chris Ward

Read more

Paul Clarke

Read more

Verity Lovelock

Read more

Xavier Fiddes

Read more

Graham Bell

Read more

Dan Loveridge

Read more

Darren Jacobs

Read more

Glen Crump

Read more

Simon Hawtrey-Coombs

Read more

Lawrence Bath

Read more

Rachel Young

Read more

Neil Kerr

Read more

Dan Gateshill

Read more

Callum Donnelly

Read more

Andy Hooper

Read more

Darren Brown

Read more

Kevin Briscoe

Read more

Paul Sams

Read more

Colin Buchan

Read more

Jamie Southall

Read more

Paul Phelps

Read more

Spencer Bowman

Read more

Donovan Long

Read more

Steve Cole

Read more

Luke Newman

Read more

Zoe Hanson

Read more

Damian Gevertz

Read more

Sally Golden

Read more

Matt Sanger

Read more

Jeremy Robbins

Read more

Nella Pang

Read more

Andy Hollands

Read more

Sam Griffiths

Read more

Alex Hurn

Read more

Zoie Golding

Read more

Ross Breckenridge

Read more

Richard Allen

Read more

Jon Martin

Read more

Steve Crawford

Read more

Louis Cross

Read more

Ian Riggs

Read more