Welcome to our Little Black Book, an inspirational series of business stories and insights from our brilliant members.

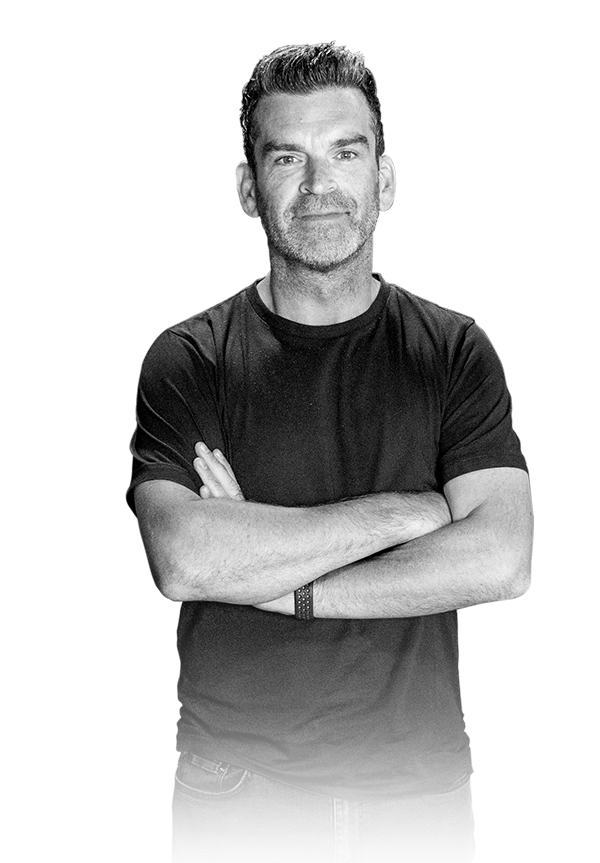

Paul Clarke on championing financial visibility for business owners

Co-founder - Ookkee

Paul Clarke is dedicated to helping business owners get ahead of the game – providing them with the financial visibility they need to succeed! Through his innovative approaches, he’s empowering entrepreneurs everywhere.

Paul may have a natural talent for numeracy, but it was his decision to become an accountant at the ripe old age of 17 that really set him on the path to success. While most of his peers were still trying to figure college, Uni or job, Paul was already diving headfirst into the world of finance and number crunching.

He’s also not your average businessman. He may have a knack for numbers, but his capabilities go way beyond that. For over 30 years, Paul has been co-founding and growing successful companies in various industries. From a security business to a home tech and entertainment company where he delivered lighting and automation projects all around the world. But that’s not all – he also co-created a global ultra-marathon series across 5 continents! When it comes to business, Paul’s creativity and desire for adventure knows no bounds.

As an entrepreneur himself, Paul knows how difficult it can be to run a business without the necessary support, especially around the area of accounting and the numbers that drive business KPI’s. That’s why he founded Ookkee – an outsourced bookkeeping service with a difference. Unlike traditional firms that simply process the numbers, Ookkee takes a business-minded approach, providing the expertise and guidance needed to empower companies to grown and succeed. By offering a range of services that are tailored to each client’s unique needs, Ookkee has quickly become a go-to resource for businesses of all sizes, allowing owners and boards to focus on what they do best: growing their company.

Connect on LinkedInDo you want more articles like this in your inbox? If so then register below...

Discover more of their secrets of success

Carianne and Sam

Read more

Jarid Hixon

Read more

Cosmic Carrot

Read more

Nick Maguire

Read more

Ben Cross

Read more

Josh Chapman & Akis Zissis

Read more

Alec Smith

Read more

Gary Frost

Read more

Kelly Bruton

Read more

Josh Mitchell

Read more

Ashley Benfield

Read more

Mike Keats

Read more

Gary Light

Read more

Faye Williams

Read more

Phil Moulds

Read more

Rich Cook & Andrew Morgan

Read more

Raveen Sandhu

Read more

Daniel Sagar

Read more

Jon Craddock

Read more

Coran Stubbington

Read more

Marc Bishop

Read more

Scott Rae

Read more

Rich Webley

Read more

Justin Neale

Read more

Heather Pierpoint

Read more

Dan Shilcock

Read more

Ben Pike

Read more

Drew Patel

Read more

Wayne Freebody

Read more

Victoria Sedgley

Read more

Paul Marsh

Read more

Victoria Chapman

Read more

Debbie Moreton

Read more

Louis Lawrence

Read more

Dan Green

Read more

Sarina Mann

Read more

Mikaela Jubb

Read more

Chelsey & Joe Terrey

Read more

Richard Browning

Read more

Neil Lewis

Read more

Ashley Fernandes

Read more

Chris Ward

Read more

Verity Lovelock

Read more

Xavier Fiddes

Read more

Graham Bell

Read more

Dan Loveridge

Read more

Darren Jacobs

Read more

Glen Crump

Read more

Simon Hawtrey-Coombs

Read more

Lawrence Bath

Read more

Rachel Young

Read more

Neil Kerr

Read more

Dan Gateshill

Read more

Callum Donnelly

Read more

Andy Hooper

Read more

Shaun Ramazannezhad

Read more

Darren Brown

Read more

Kevin Briscoe

Read more

Paul Sams

Read more

Colin Buchan

Read more

Jamie Southall

Read more

Paul Phelps

Read more

Spencer Bowman

Read more

Donovan Long

Read more

Steve Cole

Read more

Luke Newman

Read more

Zoe Hanson

Read more

Damian Gevertz

Read more

Sally Golden

Read more

Matt Sanger

Read more

Jeremy Robbins

Read more

Nella Pang

Read more

Andy Hollands

Read more

Sam Griffiths

Read more

Alex Hurn

Read more

Zoie Golding

Read more

Ross Breckenridge

Read more

Richard Allen

Read more

Jon Martin

Read more

Steve Crawford

Read more

Louis Cross

Read more

Ian Riggs

Read more